Tax Services

Make Your Taxes Easy

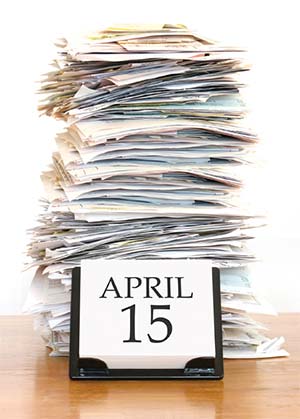

Taxes are complicated for most people. Figuring them out and filing them can be stressful and time-consuming — especially when tax regulations change.

At Shockley Bookkeeping & Taxes, we believe it should be easy for you to manage your tax liability and get the full benefit of your tax deductions. That’s why our certified tax professionals use their 25 years of combined experience to help hundreds of small business owners and individuals in and around Broken Arrow manage, prepare and file their taxes accurately and on time.

We handle federal and state tax preparation services for:

- Individuals

- Small Businesses

- Sole Proprietors

- Partnerships

- Corporations

Get the Full Benefit of Your Tax Deductions

Why hire someone to assist you with your taxes? It’s just too easy to overlook deductions and credits you’re entitled to. Even if you use a computer software program there’s no substitute for the assistance of an experienced tax professional. At Shockley Bookkeeping, we properly apply tax deductions for personal taxes and help small businesses manage their tax liability by staying up-to-date on tax regulations and offering advice for tax planning.

Here’s How:

Let's Meet

Call to schedule a 30-minute consultation to review your previous tax documents and discuss your tax situation. (For returning clients, you can simply bring us your documentation.)

Prepare Your Taxes

Our tax professional will prepare your taxes, staying in touch with you on the details.

Sign Your Taxes

We’ll email you to let you know your tax documents are ready to review and sign—either in person or by E-Sign.

File Your Taxes

Once tax return is signed and payment is received, we’ll file your taxes electronically.

Year-Round Service & Communication

Unlike other companies, the professional who prepares your taxes at Shockley Bookkeeping is available to you all year round! That puts you in control of your taxes and overall financial decisions.

We help you make better tax decisions by:

- Keeping you up-to-date on tax regulations

- Informing you on how healthcare will affect your taxes

- Showing you your tax benefits

- Recommending possible tax alternatives and ways to reduce your tax liability — legally and responsibly

We can also help you with:

- Back Taxes

- Communicating with the IRS

- Answering your tax questions year-round

Taxes Don’t Have To Be Stressful

You don’t have to dread April 15th! Stop feeling confused, stressed and worried about your tax situation. Instead, get the help of Broken Arrow’s certified tax professionals. We’ll help you understand tax regulations so you can make financial decisions and sign your tax return with confidence. Contact us today and set up an appointment for our tax professionals.